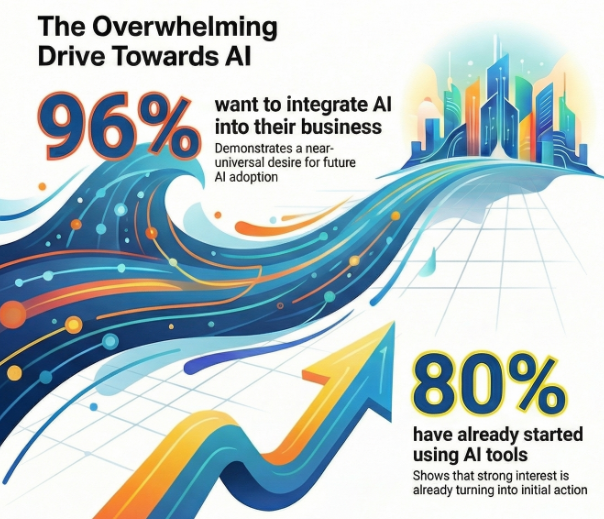

Watch Youtube Video Breakdown Here: https://youtu.be/BbkIFlpFMW0 AI is reshaping how companies operate, and entrepreneurs across Ontario are paying attention. To understand how our community is adapting, ACBN surveyed the first 100 respondents about their use of AI...